The Setup

Apologies for being a day late. There was a game on the TV I stayed up late watching Monday and it pushed me back. Sorry about that.

This week I’m going to review the TV ratings for the 2025 season. Maybe you don’t care how many people watch these games, but I promise if you stick with me I’ll tie it back to the team’s finances.

Let’s get into it.

If you’re not subscribed already, please click subscribe below to get NILnomics in your mailbox each and every week - it’s free!

House Keeping

I was horribly slow in recording my 300 Subscriber Reader Q&A. My apologies - the holidays got the best of me. For anyone interested in seeing the recording, you can find it on Youtube here. I’m hopeful I’ll hit 400 in the next few days and have another reader mailbag to go through.

I spoke at UNC-Charlotte today. The topic was sports analytics in the world of NIL. I’ll post the video once it’s available, but if you want to see the slides you can find them and the slides I’ve given for other presentations here.

The latest financial data is officially out! I’ve sent hundreds of public records requests out to get the latest data from each Division I school. If you live in the South and can help me get by some of the public record requests, please reply to this email and let me know.

This Week’s Background

2025 Television Ratings

Now that the 2025 college football season is officially over, we can start performing some retrospective analysis of the season. While others may concern themselves with on-the-field statistics, I primarily look at data points like ticket sales, attendance, sponsorships, media rights, and today’s topic - TV ratings.

I believe television ratings can be removed from their context and become one of those data points that fans like to argue over. Look at how much the NBA gets piled on by its detractors every time head-to-head ratings with the NFL come out, for example. There is something worth investigating about them because they tie into how much revenue these schools can earn.

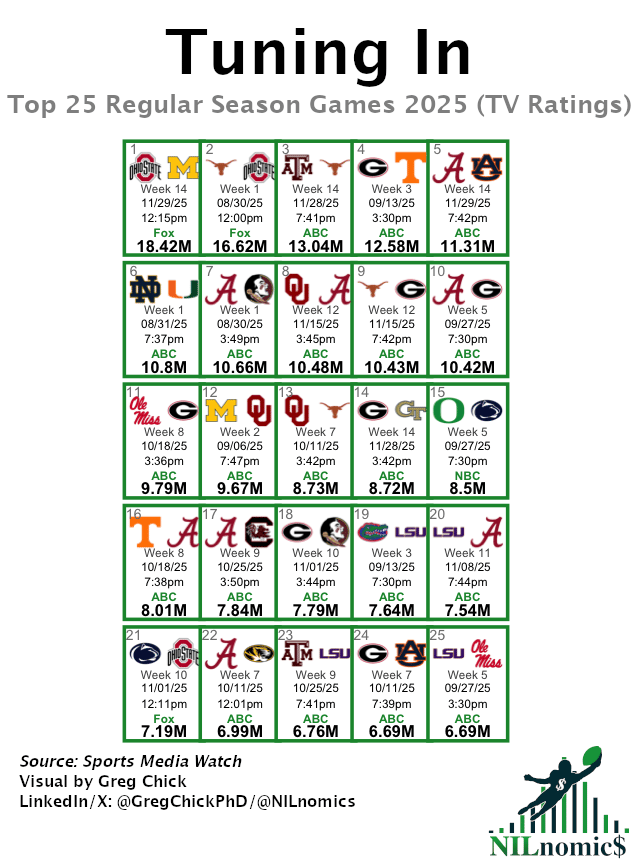

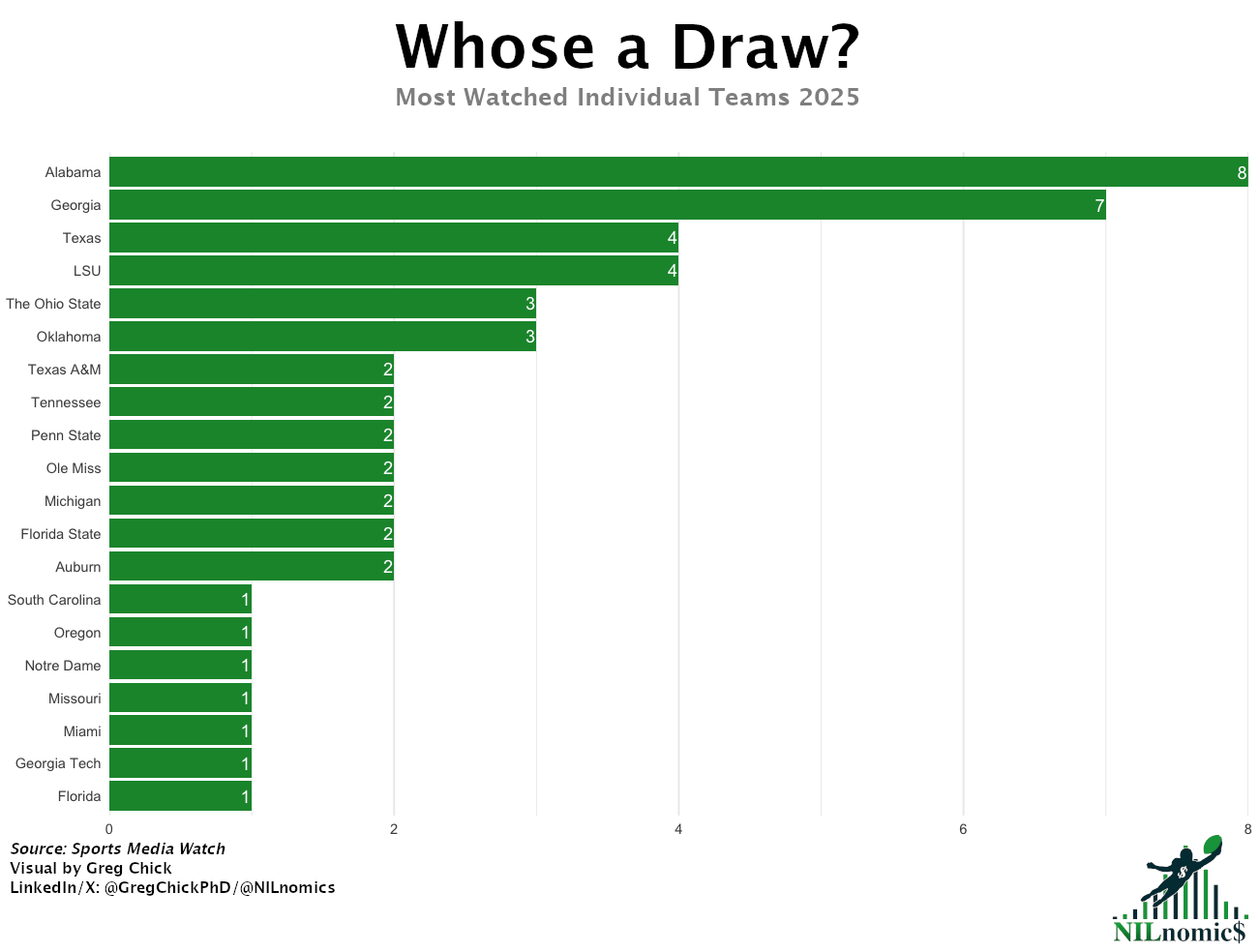

Therefore, I am starting with the top 25 rated games of the 2025 season. Let’s look at what games drew the most eyeballs then we’ll count up which teams were the most popular. That’ll help us establish a baseline for understanding media rights.

The Visual - Part 1

The Visual - Part 2

Quick Takeaways - Part 1

It’s interesting to me that the #1 & #2 games of the season were also from the first and last week of the season. The excitement of the start of the season and the anticipation of the College Football Playoff (paired with the biggest rivalry in the sport - Ohio State/Michigan) is the clear draw of the year.

In fact - week 1 had 3 games present while the last week had 4 games. More support for attention being highest at the start/end of the season.

From a network perspective, while Fox may be happy with having the #1/#2 game of the season (and #21), ABC just dominates across the board. Besides one NBC game at #15, ABC has every other spot. You have to wonder what the networks are thinking.

Looking at individual teams, the top 4 spots go to SEC teams, with 15 of the 20 teams all from the same conference.

Despite having their special arrangement with NBC, Notre Dame is all the way at the bottom with only 1 game in the top 25.

Alabama (8) has more games in the top 25 than all the ACC teams (Oregon, Miami, Georgia Tech, Florida State) combined.

More Background

2024 Media Rights

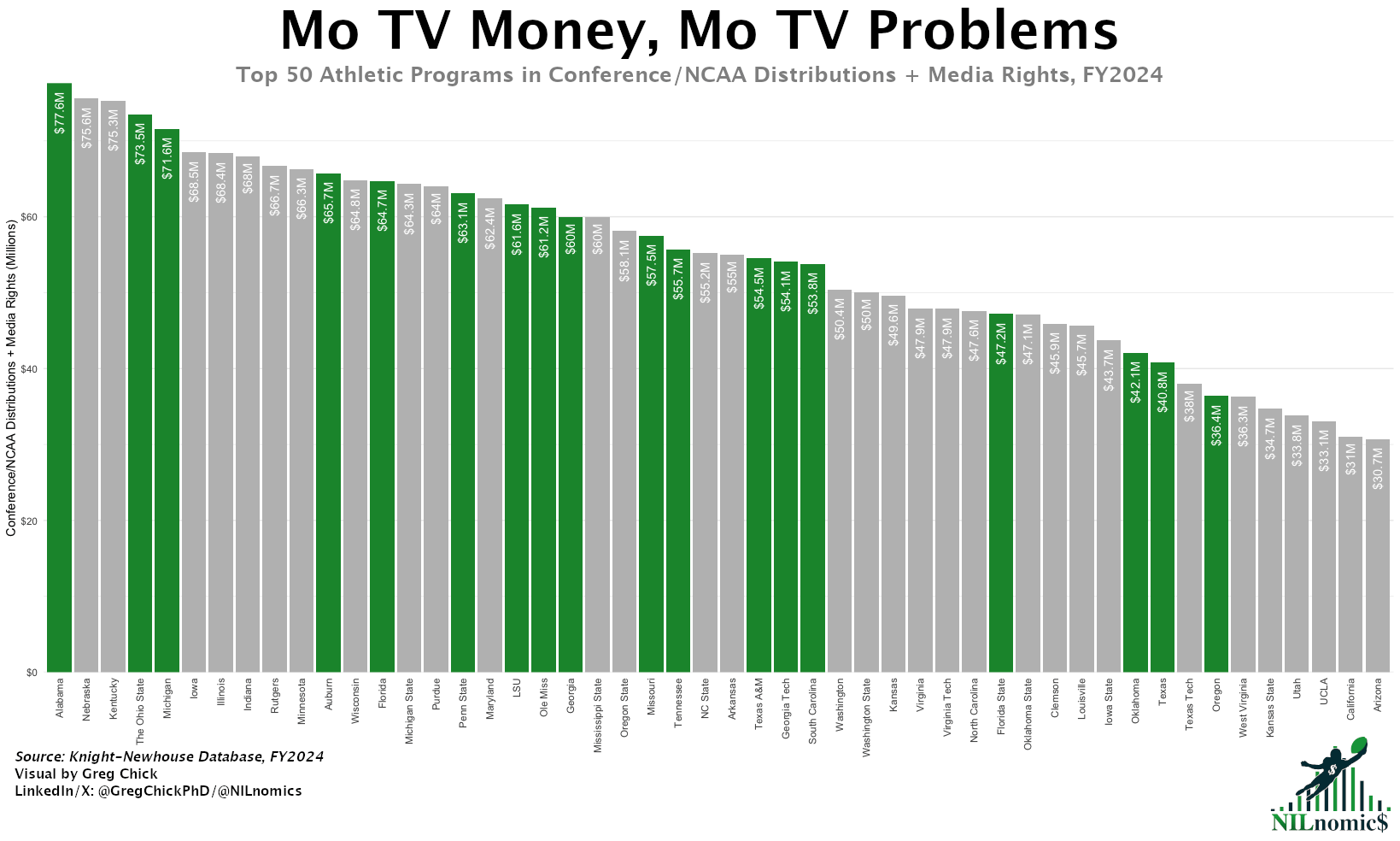

So the SEC is very popular, with their top teams (Alabama, Georgia, Texas, LSU) drawing the highest ratings across the sport. But what does that mean for their bottom line?

To understand this, I’m going to make an imperfect comparison. The latest data we have for media rights revenue has two issues. First, it’s from the 2023 season (2024 data was released just this week and I’m still assembling it). Second, the category that the Knight-Newhouse database uses combines media rights with conference/NCAA/bowl distributions. So this data has a lot more than just media rights in it.

Regardless of the imperfect methodology, I think there’s still something to learn here. I took the top 50 athletic departments in conference/NCAA distributions & media rights and highlighted those that showed up in the top 25 games this season. Let’s take a look.

The Visual - Part 3

Quick Takeaways - Part 2

Keep in mind this data is from before Oklahoma/Texas joined the SEC, Oregon joined the B1G, and before the ACC did unequal distributions of their revenue to top programs like Florida State. Once they get their new cut of the media rights, they’ll all shoot up these rankings.

Schools that are appearing the most in the highest rated televised games are generating the most in media rights.

Even those schools that aren’t in the top 25 most watched games benefit from being in the conference of the programs that do (SEC, B1G, ACC).

Many of these schools are being helped by their basketball programs (Kentucky, Iowa, Iowa, Indiana).

The graphs from this week demonstrate how tightly correlated performance in television ratings is with revenue from media rights deals.

Community Spotlight

This section is for articles, podcasts, interviews, and any other college sports related content I found interesting this week. If you have something you’d like to share, shoot me an email and it may be featured.

📰 Extra Points - Kristi Dosh breaks down what she’s seeing in revenue-sharing contracts.

📰 The State - worth reading about how the South Carolina legislature is looking to prevent revenue sharing contracts from being accessible by public records requests.

🎧 Higher Ed Athletics - Travis sits down with Daniel White, AD of Tennessee who is one of the early administrators openly calling for collective bargaining with the athletes.

🎧 College Football Today - Jackson reviews some of the latest business news around the world of college athletics.

🎧 Coaches Hot Seat - Mark has the inside sources to speak authoritatively on who controls college athletics. Fascinating information here.

🎧 JohnWallStreet - the guys interview Ivy League Executive Director Robin Harris. It’s interesting hearing how those in the ivory towers perceive the world of college athletics.

Post Game

Thanks for reading this week’s issue.

Indiana won the national title. What a wild season. College football - where anything can happen.

Until next time,

Greg Chick, PhD

Data Analyst

Analyst’s Desk

This was straightforward - television ratings data comes straight from SportsMediaWatch.com. For the real nerds out there, yes, this is all Big Data + Panel data, though some of the ratings include both Nielsen and Adobe Analytics.

Conference/NCAA distribution and media rights data comes from the Knight-Newhouse database. It would be nice if they didn’t combine so many categories like they do, but for now their definition of Conference/NCAA distributions + Media Rights is “Revenue received from athletic conferences, the NCAA, media rights, and post-season football (i.e., College Football Playoff, football bowl games).”

NILnomics is an independent data-driven newsletter uncovering the real numbers behind college sports finances with sharp insights, clear visuals, and exclusive datasets. Please send any thoughts, questions, or feedback to me at [email protected] and please follow me on X @NILnomics. Don’t forget all our data is available on Kaggle, code on GitHub, and FOIA documents on GoogleDrive. See you next week!